Editor’s Note: This article is featured in the latest edition of the Port of Brownsville Directory

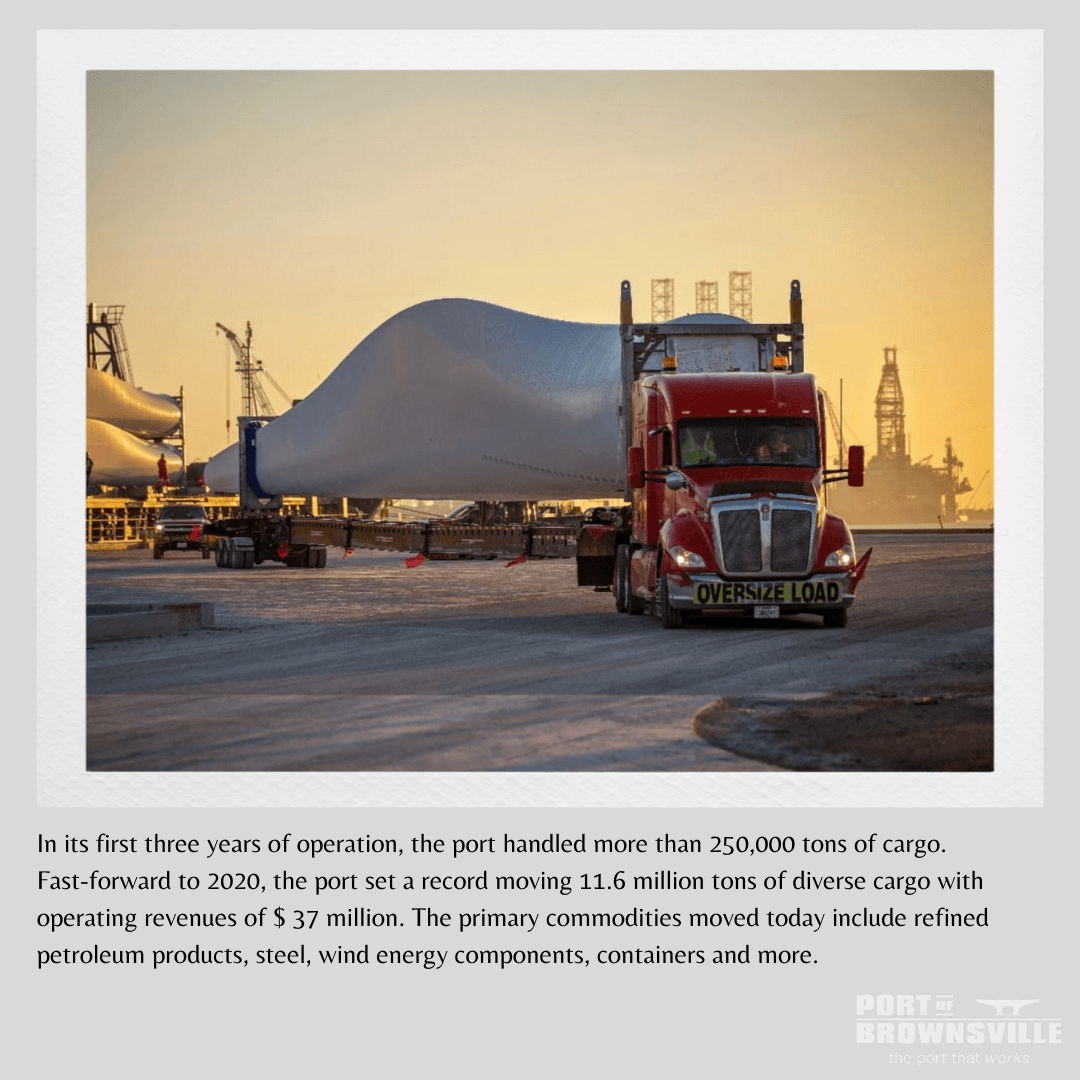

The Port of Brownsville has come a long way in its 85-year history, finding ways to overcome challenges and ever-changing global markets. The port proved resilient throughout 2020 in the face of the COVID-19 pandemic and its related economic challenges, moving a record-setting 11.6 million short tons of diverse cargo with operating revenues of $37 million, far above 2019’s high watermark of $24.6 million, providing the foundation for continued investment in economic growth, job creation and environmental stewardship for today and future generations.

Over the past several years, the port has continued to strengthen its financial position, increasing cash reserves while investing in key infrastructure improvements. The Port of Brownsville ranks third among U.S. ports for “strong financial resilience” surveyed in a 2020 report issued by Moody’s Investor Services, underscoring the ongoing value of the port’s prudent financial stewardship in light of economic impacts from the worldwide pandemic. Moody’s analysis evaluated American ports on a range of key factors surrounding financial responsibility like the ability to handle the impact of a significant decline in cargo volume, financial liquidity and debt service coverage ratio. Weighing these important factors, the analysis ranks the Port of Brownsville among the most stable in the nation and better able to weather today’s unique economic challenges.

Moody’s also highlighted the important advantages of a “landlord” business model – in which authorities like the Port of Brownsville partner with tenants primarily through stable long term leases – versus the “operator” model in which authorities conduct daily operations directly for port customers, which can result in “high revenue volatility in periods of stress.” Moody’s concluded that “the landlord model has historically proven to stabilize revenues,” underscoring the Port of Brownsville’s advantage in managing risk as the largest land-owning port in the United States, with more than 40,000 acres and available resources for large-scale industrial developers. The report also highlights the Port of Brownsville’s strong 5.0 Debt Service Coverage Ratio (DSCR), which is more than double that of most other ports Moody’s analyzed and indicates “a strong position from which to absorb and manage revenue pressures.” DSCR is a standard measure of cash flow available to pay current debt obligations. Through such careful financial management, “ports’ debt service coverage and liquidity are key credit features that enable them to manage revenue disruptions and other extraordinary challenges in this period of unprecedented stress,” the report states.

This prudent financial stewardship is the result of the thoughtful and strategic planning set by the Brownsville Navigation District Board of Commissioners to protect the interests of port tenants and users, constituents and port assets. The five-member elected commission is chartered by the State of Texas and charged with setting port policy and approving major expenditures. BND Commission members are elected to four-year staggered terms and meet twice monthly, governing the activities of the port. The BND Commission is comprised of Chairman Sergio Tito Lopez, Vice Chairman Ralph Cowen, Secretary Esteban Guerra and Assistant Secretaries John Wood and John Reed. Management of the port day-to-day activities is accomplished by Port Director and CEO Eduardo A. Campirano.

The Port of Brownsville proved resilient in 2020, moving a record-setting 11.6 million short tons of diverse cargo with operating revenues of $37 million.